Unlock Your Dream Career! 🌴

Elevate your life as a sought-after real estate agent offering Thailand’s resort hotspots, such as Pattaya, Phuket, and Koh Samui! Dive into a thriving market, connecting clients with idyllic beachfront villas, investment goldmines, and dreamy holiday escapes.

Our team offers cutting-edge technology, and an elite network. Join now and shape your future selling homes in the sun🌟

How it works

- We provide you with a complete, customizable website in your preferred language.

- You generate leads by advertising our properties.

- Once you have a lead, we take over, showing the property to potential buyers.

- When a lead becomes a sale, we handle the contract between the buyer and seller.

- As the buyer’s agent, you receive 50% of the total commission for each sale.

- Low 100 EUR monthly service fee for general website maintenance, listing update and overall website developments.

Why choose Thailand for this opportunity?

- Thailand is the world’s most visited tourist destination, attracting a high volume of tourists who often rent properties.

- High sales commissions, typically ranging from 5-9% to be shared.

- Foreigners have a significant presence in Thailand’s real estate market.

- Many attractive real estate development projects that are easy to sell.

- The sales process is straightforward, and we manage it for you.

Want To See What You Get?

The website below is a website for a Danish agent selling Thailand Properties. Your website will be created with your logo, company colours, company description etc. and the website is fully customizable so you can add your own pages and exclusive properties.

Guides and information about Thailand Real Estate

Worried about navigating the real estate market in Thailand and the legal intricacies? Don’t be. We’re here to help. We have a wealth of information available on our website, including articles about the buying process, legalities, and other relevant information. You can find all these resources right here on our page.

Buyers Guide – Completed Properties

Buying completed properties can be new properties purchased directly from a builder or developer or properties purchased in the secondary market, which have had previous owners and occupants.

WHAT TO LOOK OUT FOR

OWNERSHIP STATUS

When buying property in Thailand it is fundamental to know the legal status of the property you are buying, i.e. is the property for sale on leasehold or freehold basis.

LAND TITLE

It is recommendable for foreigners only to deal with land that is Chanote or Nor Sor Sam Gor land.

STAND ALONE PROPERTY OR PART OF A MANAGED DEVELOPMENT

The question of buying a stand alone property or a property that is part of a managed development typically is only relevant when buying houses.

The main advantage of buying a property within a managed development is that of security, maintenance and upkeep of common areas.

When buying a stand alone property the main disadvantage is the absence of security and similarly there is no one at hand for maintenance and upkeep of gardens, pool cleaning etc. This is of particular relevance if the house is a secondary/holiday residence.

PAYING FOR YOUR PROPERTY

Due to the currency exchange controls in Thailand and the requirements related to the purchase of property by foreigners some specific procedures for remitting money to pay for the property needs to be followed. To follow the specific requirements outlined below is highly important as it influence the ability to transfer money out of Thailand upon re-sale.

Foreigners which are not residents in Thailand need to bring foreign funds into Thailand by either transferring into a bank account in Thailand or use a foreign credit card to withdraw money in Thailand. When transferring foreign currency into Thailand it is important to state the purpose of the transfer “to purchase property in Thailand”.

When foreign currency is remitted to Thailand for the purchase of property, the primary evidential document is the “Foreign Exchange Transaction Certificate” which is issued by the receiving bank for transfers exceeding 50,000 USD.

Buyers Guide – Off Plan Projects

Off-plan property is a property that has yet to be built as opposed to buying a completed property. This basically means buying a promise of a property.

It is common for property developers to commence construction of a project and still refer to the property as off-plan.

Off-plan property can consist of both condominium and house developments. However the condominium market is by far the biggest in the Pattaya region at the time being. For this reason the information below relates to buying an off-plan condominium unit.

BENEFITS OF BUYING OFF-PLAN PROPERTY

The principal benefit of purchasing an off-plan condominium unit is that you get a brand new condo just by signing a contract and without further involvement in the construction process.

Another benefit is that off-plan condos typically are sold at a discounted price to the market value of already completed condominium units. It is common practice that property developers increase the price of the units during the construction period.

The initial capital requirement to secure an off-plan condo is relatively low. Even that the payment plans varies from developer to developer it is standard to only pay a reservation fee and a small deposit upon contract signing. The remaining payments become due according to the construction stages. The optimal payment plans have the largest amount due upon completion.

RISK OF BUYING OFF-PLAN PROPERTY

All forms of investments come with a certain degree of market risk. The primary risks described below as well as tools to mitigate these risks.

Market risk is the risk of market prices are going to fall. The primary driving force of the property prices in the resort areas of Thailand are related to foreigners and the development in the global economy. Though Thais has been increasing there investments in the resort areas, especially in the Pattaya area.

When buying an off-plan property the basic risk stems from the fact that, due to the nature of off-plan, that you enter into a contract without having been able to view and evaluate the finished product. The decision to buy an off-plan property is often based on advertised perspectives in magazines and on the internet. According to the Condominium Act property developers are obligated not to misrepresent the condominium, wherefore the Condominium Act offer purchasers of an off-plan condominium unit some consumer protection.

However the main risk of buying off-plan property lies in the risk of non-completion. Non-completion covers the situation where the developer is not able to complete the property due to inadequate capitalization of the developer. The risk of non-completion is to some degree present for all off-plan investments regardless of the size of the developer. However the risk of non-completion is much lower for larger enterprises with a solid track record than for a first time developer.

As mentioned the risk of non-completion relates to inadequate capitalization of the developer. From the view of the property developer selling off-plan property before construction has commenced is a way to finance the construction. This means that the capital requirement for the developer is significantly reduced. Further they will often be able to present the sale record to a bank to borrow money. In fact many developers advertise that a project is “backed” by commercial banks.

When buying into off-plan property in Thailand it is also worth considering the currency exchange rate risk. When buying off-plan property the first payment is paid when making the reservation and the last payment when the construction is completed. The construction period for condominiums often takes 2-3 years. In this period the exchange rates can fluctuate a lot and can affect the final purchase price in Thai Bath.

MITIGATING RISKS

Above has the main risks of buying off-plan properties in Thailand been outlined. Below follows a description of how the risks can me mitigated. Summarized the risks are:

Market risk

Completed property differ from expectations

Risk of non-completion

Currency exchange rate risk

MARKET RISK

Ideally everyone wants to invest when the property prices are expected to rise. In reality it is impossible to predict the future price development with a high degree of certainty. When considering the market risk it is important to keep in mind that people investing in resort areas mainly buy properties as a second home, vacation property or rental property. Baring in mind that most investors are foreigners the markets depends to a large degree on the development in the global economy rather than the Thai economy.

COMPLETED PROPERTY DIFFER FROM EXPECTATIONS

As mentioned above the developers of condominium are bind by the Condominium Act to deliver the promises made in marketing materials. However it is often worth the time of paying attention to material specifications to make sure that the quality will live up to the expectations. The level of material specifications differ from developer to developer. High end developers will usually emphasize the quality of the materials. It might also be worth the time viewing a developers other projects to assess the quality.

RISK OF NON-COMPLETION

The risk of non-completion is the most significant risk with the highest economical impact. Non-completion can be due to multiple reason such as; inadequate capital, poor financial planning, poor management, failed compliance with building regulations and insufficient sales.

Therefore it is recommendable to perform due diligence of the developer and the project before signing the purchase contract. A thorough due diligence include an assessment of; the developers financial position, reservations and sales statistics, the track record of completed projects in Thailand, the developers advisors, land titles and ownership structures.

EXCHANGE RATE RISK

As currencies fluctuate on a daily basis the risk is that the currency in which you hold money weakens against the Thai Bath during the construction period. The simplest way to avoid the risk is by transferring the full amount to a Thai bank account. Further all banks offer financial instruments to “lock” an exchange rate.

PAYING FOR YOUR PROPERTY

Due to the currency exchange controls in Thailand and the requirements related to the purchase of property by foreigners some specific procedures for remitting money to pay for the property needs to be followed. To follow the specific requirements outlined below is highly important as it influence the ability to transfer money out of Thailand upon re-sale.

When foreign currency is remitted to Thailand for the purchase of property, the primary evidential document is the “Foreign Exchange Transaction Certificate” which is issued by the receiving bank for transfers exceeding 50,000 USD.

Legal Matters – Ownership

It is often heard from foreigners in Thailand that Thai property law is complicated but in reality Thai property law is quite clear in regards to foreign ownership.

Foreigners can own “freehold condominiums”, buildings and structures (such as houses). Foreigners cannot own land but can take leases on land.

Where things get complicated is in understanding the different methods and legal structures used by lawyers to get around the strict foreign ownership regulation. Beneath will follow a description of the different methods employed to get around the foreign ownership regulation, but let us first get the general terminology defined:

“Freehold” – Freehold is the ultimate ownership interest that can be held in property and represents absolute ownership.

“Condominium” – A condominium is a building that is divided into units where each unit represents a condominium unit. Ownership of a condominium unit gives a co-ownership of the common property (condominium). It is in this way that the expressions “condo” and “apartment” differs in Thailand. When referring to apartment in Thailand it generally means that there is no co-ownership of the common property.

“Condominium freehold” – Condominium freehold is an expression used to refer to the 49% of a condominium building that can be owned in foreign name.

“Leasehold” – Leasehold is an interest in land or any type of property but where the ownership is not transferred.

LEGAL PROPERTY OWNERSHIP

CONDOMINIUM FREEHOLD

Buying a condominium freehold unit is the easiest and most favored by foreigners to acquire direct property ownership in Thailand, as they can be hold directly in foreign name and the process of buying is clear and straightforward.

A condominium is regulated by the Condominium Act and according to the Condominium Act 49% of the registrable area of a condominium can be allocated to foreign purchasers.

FREEHOLD

Thai property law does not allow for foreign individuals or foreign companies to own freehold interest in land, except for a few exceptions which will not be described here as they are not relevant for the usual investors in Thai property. Foreigners can get indirect ownership of the land through a Thai company or through leasehold ownership. These two forms of ownership are described below.

Foreign individuals and foreign companies can hold freehold ownership of condominium units, as described under Condominium freehold and building and structures on land, such as houses.

LEASEHOLD

A leasehold agreement is a legal interest that can be registered as a lien on the property title deed and secures an exclusive possession and use right. There is no restrictions on the foreign ownership of a lease hence it is possible for foreigners to register the lease directly in a personal name, or in the name of a Thai or foreign company.

The Land Department in Thailand currently only allows leases with a maximum period of 30 years to be registered. However they do allow for private agreements to contain renewal options for another 30 + 30 years so it in fact becomes a “90-year lease”.

The renewal clauses are governed by the legal principal “privity of contract” and hence only binding for the parties who signed the contract. This could raise a potential problem if the freehold land is sold or transferred and the Supreme Court of Thailand has ruled that only the legally registered leases will transfer and follow the title deed to the new owner.

Due to the potential problems that can arise if the freehold land is sold or transferred it is important to create a protective leasehold structure.

Further it should be noted that lease contracts are personal in nature, which means the contract terminate upon the death of a lessee. Therefore it is important to include a succession clause stipulating that lessee’s rights and obligations will be assigned to the lessee’s heirs.

LEASEHOLD WITH OPTION TO PURCHASE THE FREEHOLD LAND

Due to the fact that only the first 30-year lease of the 30+30+30 year leasehold structure is registrable on the title deed a leasehold agreement with an option to purchase the freehold provides the purchaser with a greater security and control over the freehold land.

With a clause to purchase/transfer the freehold land the purchaser has the ability to control who becomes lessor and therefore will be able to transfer the freehold land to himself should the Thai ownership regulation change in the future or to any entity over which he has control.

In practice upon entering into the leasehold agreement the lessor hands over the title deed to the lessee and provides lessee with a Power of Attorney to allow lessee to transfer the freehold land ownership to any entity designated by the lessee at any time.

THAI LIMITED COMPANIES

As Thai law does not allow foreigners to own a direct freehold interest in land it has been a common accepted method to use a Thai Limited company as a vehicle for holding freehold land and all other kind of properties in Thailand. The reason why this is possible is that a Thai Limited company commands the same legal rights as a Thai citizen.

However it is not possible for foreigners to hold more than 49% of the registered capital of a Thai limited company and there must be more Thai shareholders than foreign shareholders. Therefore it is important to understand the crucial difference between ownership and control.

The Thai shareholders will own the majority of the registered capital (51%) but the foreigner will control the company through voting rights. Technically this is done by dividing the company’s share capital into two different classes which each has different voting rights and where the foreigner holds the preference shares. By doing this it is possible to get 100% control over the company.

By having 100% control over the company also means that the controlling shares have superior rights in relation to dividends and distribution upon liquidation of the company.

The setup procedure of a Thai Limited company is a relative simple procedure and with low setup costs.

Legal matters – Taxation

It is the fewest people that consider taxation upon sale when investing in property in Thailand. However while Thailand doesn’t technically have a tax on “capital gains” it is taxed like any other form of income.

Depending on the ownership structure capital gains are taxed through personal or corporate income taxes.

Therefore, as some ownership structures are more tax efficient than others upon sale you risk giving up a significant part of any capital gains in taxes. It is advisable to ensure professional advice already at the acquisition stage.

In the following is described the taxation upon sale which is based on the interplay between legal ownership (leasehold, freehold, condominium freehold) and the ownership structure (personal name, Thai company, foreign company).

TAXES UPON SALE OF LEASEHOLD PROPERTY

The transfer procedure and tax consequences upon sale are different for the three primary forms of leasehold ownership. Below is outlined the consequences upon sale for the ownership forms; personal name, Thai company and foreign company.

PERSONAL NAME

A lease is considered sold/transferred when the lease is registered in the name of the new owner. Upon transfer of ownership the land office will collect 1% in registration fee and 0.1% in stamp duty. The fees are calculated based on the appraised value and not the sale price. The appraised value is a government assessed value which is used to determine the tax amount that must be paid. The appraised value is often lower than the actual sale price.

Any capital gains based on the government assessed value is subject to personal income tax, which currently is taxed at a rate ranging from 0% – 37%. A standard deduction for expenses is allowed against the appraised value with a maximum of 50% for ownership of 8 years more.

THAI COMPANY

If a lease is hold through a Thai company the taxation depends on whether the lease is sold by selling the property out of the company or the shares in the company holding the lease is sold.

If the lease is sold by transferring the controlling shares to purchaser the transfer fees are limited to 0.1% stamp duty. However the seller of the shares is subject to personal income tax at a rate ranging from 0% – 37%.

If the lease is sold out of the company the transfer fees applicable to the lease will apply. This means 0.1% stamp duty and 1% registration fee has to be paid at the land office. Since the seller is the company any capital gains will be subject to corporate income tax, which is taxed at a rate ranging from 0% – 20%

FOREIGN COMPANY

If a lease is hold through a foreign company the taxation depends, as for a Thai company, on whether the lease is sold by selling the property out of the company or the shares in the company holding the lease is sold.

If the lease is sold by transferring the controlling shares to purchaser no taxable events has taken in place in Thailand.

If the lease is sold out of the foreign company a taxable event has taken place in Thailand which means 0.1% stamp duty and 1% registration fee has to be paid at the land office. Further the foreign company is subject to 15% withholding tax.

TAXATION UPON SALE OF CONDOMINIUM FREEHOLD

The transfer procedure and tax consequences upon sale are different for the three forms of ownership of “condominium freehold”. Below is outlined the consequences upon sale for the ownership forms; personal name, Thai company and foreign company.

PERSONAL NAME

When a condominium freehold title has been transferred to a new owner a 2% registration fee will be collected by the land office. Further either a Specific Business Tax of 3.3% or stamp duty of 0.5% is payable. The Specific Business Tax is payable if the “condominium freehold” has been transferred within the last 5 years and stamp duty is payable if it has not been transferred within the last 5 years and if the property has been used as the sellers residential home. Specific Business Tax is an assessment tax calculated over the registered sale value or the government appraised value of the property, whichever is higher.

In addition any capital gain based on the government assessed value is subject to personal income tax, which currently is taxed at a rate ranging from 0% – 37%. A standard deduction for expenses is allowed against the appraised value with a maximum of 50% for ownership of 8 years more.

THAI COMPANY

If a condominium freehold title is hold through a Thai company the taxation depends on whether it is sold by selling the property out of the company or the shares in the company holding the condominium freehold title is sold.

If the condominium freehold title is sold by transferring the controlling shares to purchaser the transfer fees are limited to 0.1% stamp duty. However the seller of the shares is subject to personal income tax at a rate ranging from 0% – 37%.

If the condominium freehold title is sold out of the company the transaction fees applicable to the condominium freehold will apply. This attracts a 2% transfer registration fee, 1% withholding tax (as the seller is a company) and 3.3% Specific Business Tax. In addition the Thai company will be subject to corporate income tax on capital gains, which is taxed at a rate ranging from 0% – 20%

FOREIGN COMPANY

If a condominium freehold title is hold through a foreign company the taxation depends, as for a Thai company, on whether the condominium freehold title is sold by selling the property out of the company or the shares in the company holding the condominium freehold title is sold.

If the condominium freehold title is sold by transferring the controlling shares to purchaser no taxable events has taken in place in Thailand.

If the condominium freehold title is sold out of the foreign company a taxable event has taken place in Thailand which attracts a 2% transfer registration fee, 1% withholding tax (as the seller is a company) and 3.3% Specific Business Tax. Further the foreign company is subject to 15% withholding tax.

TAXATION UPON SALE OF FREEHOLD PROPERTY

With regards to foreigners the most common forms of freehold relates to houses and land controlled through a Thai company. The transfer procedure and tax consequences upon sale of freehold property are different for the three forms of ownership of freehold property. Below is outlined the consequences upon sale for the ownership forms; personal name, Thai company and foreign company.

PERSONAL NAME

As Thai law contains no provisions for foreigners to own freehold land, the only freehold property, with the exception of “condominium freehold” that foreigners can poses is structures built on land which usually means houses.

When a freehold title has been transferred to a new owner a 2% registration fee will be collected by the land office. Further either a Specific Business Tax of 3.3% or stamp duty of 0.5% is payable. The Specific Business Tax is payable if the “condominium freehold” has been transferred within the last 5 years and stamp duty is payable if it has not been transferred within the last 5 years and if the property has been used as the sellers residential home. Specific Business Tax is an assessment tax calculated over the registered sale value or the government appraised value of the property, whichever is higher.

In addition any capital gain based on the government assessed value is subject to personal income tax, which currently is taxed at a rate ranging from 0% – 37%. A standard deduction for expenses is allowed against the appraised value with a maximum of 50% for ownership of 8 years more.

THAI COMPANY

If a freehold title is hold through a Thai company the taxation depends on whether the land and/or buildings is sold by selling the property out of the company or the shares in the company holding the freehold title is sold.

If the property is sold by transferring the controlling shares to purchaser the transfer fees are limited to 0.1% stamp duty. However the seller of the shares is subject to personal income tax at a rate ranging from 0% – 37%.

If the property is sold out of the company the transaction fees applicable of the freehold property will apply. This attracts a 2% transfer registration fee, 1% withholding tax (as the seller is a company) and 3.3% Specific Business Tax. In addition the Thai company will be subject to corporate income tax on capital gains, which is taxed at a rate ranging from 0% – 20%

FOREIGN COMPANY

As Thai law contains no provisions for foreign companies to own freehold land, the only freehold property, with the exception of “condominium freehold” that foreign companies can poses is structures built on land which usually means houses

If a freehold title is hold through a foreign company the taxation depends, as for a Thai company, on whether the freehold title is sold by selling the property out of the company or the shares in the company holding the freehold title is sold.

If the freehold title is sold by transferring the controlling shares to purchaser no taxable events has taken in place in Thailand.

If the freehold title is sold out of the foreign company a taxable event has taken place in Thailand which attracts a 2% transfer registration fee, 1% withholding tax (as the seller is a company) and 3.3% Specific Business Tax. Further the foreign company is subject to 15% withholding tax.

TAXES ON RENTAL INCOME

Rental income from property situated in Thailand is taxable income, but the level of taxes payable depends on the property ownership structures. Below is outlined the tax implications for the different ownership forms; personal name, Thai company, foreign company.

PERSONAL NAME

All rental income is taxable, regardless of nationality, residence status or whether rent is received within or outside of Thailand. The net rental income is subject to personal income tax at a rate ranging from 0% – 37%. Property owners are permitted a standard 30% deduction for expenses against rental income or claiming actual expenses incurred.

If a property is rented out to a company a 5% withholding tax shall be deducted from the rental receipts. There is no withholding tax if the property is rented to a person.

THAI COMPANY

All rental income is taxable and the rental income is subject to corporate income tax at a rate ranging from 0% – 20%.

If the property is rented out to another company a 5% withholding shall be deducted from the rental receipts. There is no withholding tax if the property is rented to a person.

FOREIGN COMPANY

Whether the rental income is taxable in Thailand depends on whether the company is carrying out business in Thailand. A foreign company is carrying out business in Thailand if the foreign company has an employee, a representative or go-between to manage the property in Thailand.

If a foreign company is not carrying out business in Thailand the tax payable is 15% of the gross income. If the company is carrying out business in Thailand the foreign company is subject to corporate income tax of a rate ranging from 0% – 20%.

Thailand’s Primary Resort Destination

Hua Hin – A Tranquil Haven at the Gulf of Thailand with golden beaches

Nestled on the Gulf of Thailand’s quiet shores, Hua Hin stands as a peaceful retreat, inviting both vacationers and expatriates to experience its understated charm. Located 200 kilometers southwest of bustling Bangkok, this coastal town offers a harmonious blend of natural beauty, cultural depth, and modern amenities.

A Relaxing Retreat for Vacationers

Serene Beaches: Hua Hin’s coastline boasts tranquil stretches of sandy shores, ideal for leisurely walks, sunbathing, and gentle ocean swims.

Cultural Heritage: The town’s historical sites, such as the Maruekhathaiyawan Palace, and the bustling night market reflect its rich cultural tapestry.

Nature’s Embrace: Beyond its beaches, Hua Hin offers lush national parks and opportunities for outdoor enthusiasts, including golf courses and water sports.

Local Flavors: A visit to the local night market introduces travelers to the flavors of Thai cuisine and the vibrant atmosphere of its streets.

A Tranquil Abode for Expatriates

Quality of Life:Hua Hin provides a serene quality of life marked by its calm ambiance, well-kept streets, dependable public services, and modern healthcare facilities.

Cost-Effective Living:The town’s cost of living is notably affordable compared to Western countries, covering housing, groceries, transportation, and healthcare.

Welcoming Community: Hua Hin fosters a close-knit expatriate community, offering newcomers opportunities to connect through various clubs, groups, and social events.

Healthcare Facilities:Modern healthcare facilities staffed by English-speaking professionals ensure residents have access to quality medical services.

Convenient Accessibility:Hua Hin’s connectivity to major cities, including its international airport, simplifies travel for both residents and tourists.

Balmy Climate:Hua Hin enjoys a tropical climate with comfortable year-round temperatures, highlighted by abundant sunshine.

In summary, Hua Hin, Thailand, embodies the essence of a peaceful coastal retreat and an inviting place to settle down. Its serene beaches, cultural richness, and outdoor pursuits make it a haven for vacationers, while its tranquil quality of life, affordability, and close-knit expatriate community create a welcoming environment for those seeking a new home. Hua Hin’s understated charm beckons you to explore and experience its tranquil embrace.

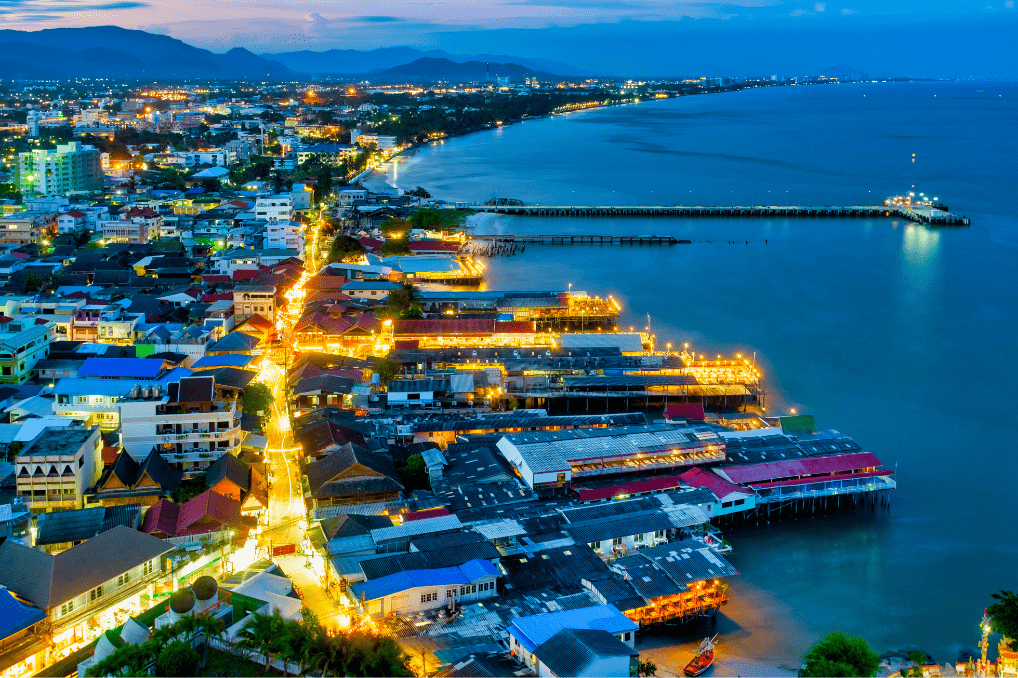

Pattaya – A Coastal Gem with big city advantages

Nestled on the Gulf of Thailand, Pattaya is a coastal paradise that draws both holidaymakers and expatriates to its vibrant shores. Located approximately 150 kilometers southeast of Bangkok, this dynamic city offers a blend of natural beauty, entertainment, and modern amenities that cater to diverse lifestyles.

A Playground for Vacationers

Beachfront Bliss: Pattaya’s stunning coastline stretches for miles, providing the perfect backdrop for beach lovers. The golden sands invite visitors to sunbathe, take leisurely walks, or engage in water sports.

Entertainment Hub: Beyond the beach, Pattaya is renowned for its nightlife and entertainment options. The city comes alive after dark with a multitude of bars, clubs, and shows, making it a hub for entertainment seekers.

Cultural Diversions: Pattaya offers glimpses of Thai culture at its local markets, where street food vendors and artisans showcase their talents. The Sanctuary of Truth, a breathtaking wooden temple, is a testament to the city’s cultural depth.

Outdoor Adventures: For those seeking outdoor experiences, Pattaya offers activities such as snorkeling, scuba diving, and golfing. Nearby islands like Koh Larn provide a tranquil escape from the bustling city.

A Welcoming Home for Expatriates

Diverse Community:Pattaya boasts a diverse expatriate community, creating a welcoming and inclusive environment. Residents have opportunities to connect through clubs, cultural exchanges, and social gatherings.

Cost-Effective Living:The cost of living in Pattaya is comparatively affordable, covering housing, groceries, dining, transportation, and healthcare. Expatriates find value in their daily expenses.

Healthcare Facilities:Pattaya is equipped with modern healthcare facilities staffed by English-speaking medical professionals, ensuring residents have access to quality medical care.

Convenient and Accessibility:The city’s infrastructure is well-developed, providing easy access to major cities through highways and the nearby U-Tapao International Airport. Pattaya’s accessibility simplifies travel within Thailand and abroad.

Tropical Climate:Pattaya enjoys a tropical climate, offering warm temperatures throughout the year, although the rainy season can be quite wet.

In summary, Pattaya, Thailand, is a coastal haven that effortlessly combines vibrant entertainment with the comforts of expatriate living. Its stunning beaches, lively nightlife, and cultural attractions make it an ideal destination for vacationers, while its diverse expatriate community, affordability, and modern amenities create a welcoming environment for those seeking a new home. Pattaya’s dynamic atmosphere invites exploration and provides a lively backdrop for both holidaymakers and expatriates.

Phuket – A Tropical Island in the South of Thailand

Nestled in the Andaman Sea, Phuket is a tropical haven that has captured the hearts of holidaymakers and expatriates alike. Situated in the southwestern part of Thailand, this island gem offers a unique blend of natural beauty, cultural allure, and modern comforts that make it a coveted destination for relaxation or a place to establish roots.

A Holiday Oasis

Beachfront Bliss: Phuket’s coastline boasts world-renowned beaches with pristine sands and crystal-clear waters. Whether it’s Patong, Karon, or Kata Beach, visitors can unwind, swim, or indulge in water sports.

Cultural Charm:Beyond the beaches, Phuket offers a rich cultural experience. The Old Town’s colonial architecture and vibrant markets showcase the island’s heritage. Temples like Wat Chalong provide spiritual insights.

Adventurous Escapades: For the adventurous, Phuket offers a plethora of outdoor activities, from jungle trekking and zip-lining to diving and snorkeling in the stunning coral reefs of the Andaman Sea.

Gastronomic Delights: The island’s dining scene is a delight for food lovers, with a wide range of international and Thai cuisine. Fresh seafood markets offer delectable dishes by the sea.

A Home in Paradise for Expatriates

Quality of Life: Phuket provides a high quality of life, offering a relaxed pace of living amidst breathtaking natural surroundings. Clean streets, efficient services, and excellent healthcare facilities enhance the overall experience.

Cost-Effective Living:The cost of living in Phuket, while somewhat higher than mainland Thailand, remains reasonable compared to many Western countries. Expatriates can find affordable housing, dining, transportation, and healthcare options.

Expatriate Community:The island hosts a diverse and welcoming expatriate community. Numerous clubs, groups, and events provide opportunities to connect with like-minded individuals and foster meaningful relationships.

Healthcare Excellence:Modern hospitals and clinics staffed with English-speaking medical professionals ensure residents have access to top-notch healthcare services.

Island Accessibility: Phuket is well-connected, with its international airport facilitating travel to and from the island, as well as convenient access to other parts of Thailand.

Tropical Bliss: Phuket enjoys a tropical climate with warm temperatures year-round, offering ample sunshine and occasional tropical showers.

In summary, Phuket, Thailand, is a paradise that offers a harmonious blend of idyllic vacation experiences and the practicality of expatriate living. Its breathtaking beaches, rich culture, and adventurous activities make it a dream destination for travelers, while its high quality of life, affordability, and diverse expatriate community create an inviting space for those seeking a new home. Phuket’s natural beauty and cultural allure invite exploration and provide a backdrop for both unforgettable holidays and fulfilling expatriate living experiences.

Koh Samui – A Tropical Sanctuary in the Gulf of Thailand with attractive nearby islands

Nestled in the Gulf of Thailand, Koh Samui is a tranquil island paradise that beckons travelers and expatriates with its serene charm. Situated off the southeastern coast of Thailand, this idyllic island offers a serene blend of natural beauty, cultural allure, and modern comforts that make it a sought-after destination for both leisure and a potential new home.

A Retreat for Vacationers

Beachfront Paradise: Koh Samui’s coastline is its greatest treasure. Pristine beaches with powdery sands, such as Chaweng and Lamai Beach, invite visitors to bask in the sun, swim in azure waters, and explore coral reefs teeming with marine life.

Cultural Exploration: The island offers glimpses of Thai culture in its local markets and Buddhist temples. The Big Buddha Temple and Fisherman’s Village showcase the island’s heritage and provide a tranquil escape.

Nature’s Embrace: Beyond the beaches, Koh Samui is blessed with lush jungles, waterfalls, and hiking trails. Activities like snorkeling, kayaking, and island-hopping to nearby Angthong Marine National Park are popular among adventurers.

Culinary Delights: Koh Samui’s dining scene is a fusion of international and Thai flavors, with beachside restaurants offering fresh seafood and local delicacies.

A Serene Home for Expatriates

Quality of Life: Koh Samui provides a high quality of life with its unhurried pace and pristine surroundings. The island’s infrastructure is well-maintained, and healthcare facilities meet international standards.

Cost-Effective Living:While slightly pricier than mainland Thailand, the cost of living on Koh Samui remains reasonable compared to Western countries. Accommodation, dining, transportation, and healthcare are accessible and affordable.

Expatriate Community:Koh Samui boasts a close-knit expatriate community, offering a warm and inclusive atmosphere. Residents have opportunities to connect through social clubs, cultural events, and community gatherings.

Healthcare Excellence:Modern medical facilities staffed with English-speaking professionals ensure residents have access to high-quality healthcare services.

Island Convenience: Koh Samui’s airport offers direct flights to Bangkok and other major cities. The island’s size makes travel convenient, and the relaxed atmosphere enhances the overall experience.

Tropical Climate: Koh Samui enjoys a tropical climate, with warm temperatures year-round and occasional rain showers during the wet season.

In summary, Koh Samui, Thailand, is a tropical haven that gracefully combines serene vacation experiences with the comforts of expatriate living. Its pristine beaches, cultural depth, and outdoor pursuits make it a dream destination for travelers, while its high quality of life, affordability, and welcoming expat community create a peaceful and inviting haven for those considering a new home. Koh Samui’s natural beauty and cultural charm offer an opportunity for both unforgettable holidays and a fulfilling expatriate lifestyle.

Want to find out more?

Send us message and we will get back to you shortly – Or schedule a Google Meet call with us below.

Apply now for your custom designed website

Apply now for your custom designed website